Ad concept testing surveys are like taking a test drive before purchasing a car.

Buying a car is a large investment, so the vehicle must meet all your expectations. The same can be said for marketing and advertising campaigns.

Would you purchase the vehicle if you had to guess what the gas mileage would be, what the color of the interior was, and what features your family would want for your trip across the country next summer?

Probably not.

So why jump into an advertising campaign without knowing what to expect, how the audience will receive the ad, and how well it will perform?

You shouldn’t.

In this ultimate guide, our market research company provides a comprehensive overview of ad concept testing surveys including how to develop and conduct them.

Article Contents 📝

- What is an Ad Concept Testing Survey?

- The Benefits of Conducting Ad Concept Testing Surveys

- The Importance of Using a Third-Party Market Research Company

- How to Conduct Ad Concept Testing Surveys

- Monadic vs. Sequential Monadic Survey Design

- Ad Concept Testing Example Survey Questions

- Types of Ad Concept Survey Analysis

- How Long Does Ad Concept Testing Research Take?

- The Cost of Ad Concept Testing Surveys

- Ad Concept Testing CasE Study

What is an Ad Concept Testing Survey?

The easiest way to define ad concept testing is that it is a way to develop and refine marketing campaigns before they go public.

As we like to say at Drive Research, it is essentially a test drive.

Using market research to put ad concepts to the test

We have all been there. The light bulb goes off in your head. This is the golden idea for an advertisement about your company's newest offering.

It is engaging, entertaining, and effective all at once. It sounds like a recipe for success!

But wait…what if the message doesn't ultimately resonate with the audience? You get it. Your team gets it. But will consumers get it?

What if you spend your entire marketing budget on an advertisement that doesn’t offer any ROI?

And to top it off, your co-worker just had another great idea that sounds like it could work, too.

So, where does your marketing and advertising team go from here?

Ask key questions among your target audience and get answers about factors such as:

- Does our ad copy and messaging resonate?

- Are we using the right graphics and visuals to drive home our message?

- What are the best advertising channels for these ads?

- Is the placement and layout of the ad easy to understand?

- Is this ad memorable?

- What does the target audience like and dislike about the ad?

- What is the first thing that draws their attention?

Whether the goal is awareness or conversions, the only way to really know if your ad is compelling enough is to concept test.

Once the feedback is gathered from respondents, an analysis of the data will often reveal new ideas and revisions to give your campaign the best chance for success.

💡 The Key Takeaway: You’ve got a great idea for an ad, but now what? Ad concept testing will provide you with the right answers by gathering quality feedback about your concept.

The Benefits of Conducting Ad Concept Testing Surveys

There are several reasons brands choose to conduct marketing and advertising market research.

Our market research company often recommends concept testing to brands who are:

- Promoting a new product or service

- Referencing a sensitive topic

- Speaking to a new target demographic or market

- Debating between multiple different designs

- In need of proof of concept for leadership teams or investors

Regardless of your type of campaign or project objectives, executing an ad concept survey is never a bad idea.

If anything it acts as a gut check in a world where many marketing campaigns are based on guesswork and assumptions.

Let’s dive into the main benefits of concept testing with surveys.

Benefit #1: Maximize Your Advertising ROI 💰

Using data to select the right campaign is almost sure to save and make your company money.

Before you invest any unnecessary time and resources into these ideas, find out which one gives you the best chance to increase the return on investment.

Sure, a return of 2X or 3X your investment is great – but what if you conducted ad concept testing first and it produced a return of 10X your investment?

For example, Drive Research conducted an eCommerce user experience project on behalf of a client that needed market research to revitalize their website and make it more user-friendly.

After implementing the changes from consumer feedback, conversion rates and sales increased by 65%. We increased sales at a rate of 7X the cost of market research.

Many marketers are familiar with the A/B testing concept.

For context, a brand is running a digital advertising campaign on Facebook.

There are hundreds of articles online that tell companies to run two ads for a few days and see which of the two is generating more link clicks, engagement, and other common key performance indicators.

However, who is to say these two ads are even the best possible options?

Perhaps if after concept testing there was an opportunity to change the design or message based on feedback from your target audience.

Spend a little money now, to save thousands later.

Also, who’s to say Facebook is even the best advertising option for your audience?

Beyond using market research to help fuel concepts (messaging, emotions, word association, etc.) it can also be used on the back-end of creative and design.

Once you have ads or creative mocked up, market research can help you choose the best go-to-market approach and campaign.

Ad concept testing sets your brand up for success from the very beginning. It’s better to spend a little money now, before wasting thousands of dollars on an advertising campaign that will generate no return.

Recommended Reading: Understanding the ROI of Market Research for Advertising

Benefit #2: Gain Real Consumer Reactions 😃😞

Ad concept testing allows a company to put several ideas in front of a target audience and get honest reactions to help make data-driven decisions.

Typically after developing new advertising designs, a marketing team will present their concepts to a larger group of decision-makers.

The decision-makers may be a leadership team, a client, or whoever must sign the dotted line to give a marketing campaign the green light.

Unfortunately, this process assures no one that the campaign will actually work.

Think about the number of times brands run a commercial or marketing campaign and receive a great deal of backlash. The one instance that stands out in my mind is Pepsi.

Pepsi had to pull a commercial starring Kendal Jenner after it was accused of trivializing the Black Lives Matter movement.

It makes you wonder how many people were involved in creating this commercial that thought it would be a smashing success.

If only the decision-makers at Pepsi conducted an ad concept testing survey with real consumers in the initial stages of creating the commercial. It could have saved them millions of dollars.

Benefit #3: Data-Driven Marketing Strategy 📊

In the marketing realm, it seems like best practices and industry standards are constantly changing. What worked in Quarter 1 may be considered a flop in Quarter 2.

It’s challenging to keep up with the latest marketing trends on top of your already busy work schedule.

The second you feel like you’ve mastered one strategy such as paid digital marketing or search engine optimization, Google comes out with new rules marketers should abide by.

The reason it seems like the marketing industry is continuously evolving is that it so heavily relies on consumer behavior and trends.

The more customer expectations, preferences, and needs change, the more our advertising strategies must change with it.

Take, for example, the COVID-19 pandemic.

According to this study, 75% of Americans have tried a new store, brand, or different way of shopping during the pandemic. How customers respond to marketing and advertising campaigns now is entirely different than pre-pandemic.

In a prior post, we talked about measuring shifts in consumer behavior due to COVID-19 if you’re interested in learning more!

The greatest way to identify shifts in consumer preferences is with a data-driven marketing strategy. More times than none this includes ad concept testing research.

Concept testing research allows organizations to use data-driven insights to determine brand names, slogans, copy, design, and other key factors.

This type of exclusive research helps brands regain market share even in the most competitive industries.

Especially If there are a lot of directions you could go with your campaign, you will be glad you completed ad concept testing.

💡 The Key Takeaway: There are a large number of benefits to ad testing. Not only do you potentially save large amounts of money, but you’ll also be putting out tested content that resonates with your audience.

Recommended Reading: 4 Ways Market Research Can Improve Your Advertising

The Importance of Using a Third-Party Market Research Company

When brands decide to add a component of ad concept testing to their marketing strategy, their first thought tends to conduct this research with their in-house marketing team or marketing agency.

However, it is not recommended to work with a marketing agency but instead with a third-party market research company. Here’s why.

Zero Preconceived Notions 🤔

When you work in a specific industry for an extended period, there are natural preconceived notions that develop regarding your body of work.

For example, marketing professionals who have worked in this field for years can tell you how to craft the perfect Facebook ad - down to the word count.

While this experience is more helpful than not, it can deter people from growing with new trends as consumer preferences continue to change and evolve.

For this reason, crucial questions can be skipped over in an ad concept testing survey because marketing professionals think they already know the answer.

In reality, there are likely to have been a few surprises in the data that could have skyrocketed an advertising campaign.

As a market research company, our team knows the importance of having a fresh perspective when it comes to both qualitative and quantitative studies.

Of course, everyone has certain assumptions of how results will skew, but it is better to let consumer data and feedback speak for themselves.

It helps to have a third-party market research firm act as an outsider in this type of study.

They are not as invested in the advertising concepts therefore they can craft unique, unbiased questions.

This team can bring in a fresh new perspective as well as their own market research best practices.

Unbiased Opinions 💡

Imagine this. You spend weeks meeting with your team to develop several new advertisement campaigns that will be displayed throughout several marketing channels.

Your project manager, copywriter, and graphic designer all work together to create an idea they believe will be a slam dunk.

Before launching the campaign, the president of the company wants to test these designs to assure the best return on investment possible.

Fast forward a few weeks later and results from the ad concept testing survey come in.

⏩⏩⏩

Respondents overwhelmingly report their likelihood to purchasing the products advertised had not changed after seeing the advertisement.

After all the hard work you and your team put into creating these designs, it is nearly impossible to have unbiased feelings about these results.

Some people would choose to throw out the data collected from the market research, rather than the advertisements that took weeks to develop.

When someone's time and work are on the line, it is hard not to persuade the results to benefit them. They think they know their target market better than any random sample of respondents.

However, as a market research company, we know this is not the case.

The respondents who take an online ad concept testing survey are those that match your target demographic and represent how a large sample of consumers will react.

As an unbiased third party, market research companies deliver data that is not skewed to benefit the copywriter or graphic designer responsible for the concept.

We deliver data in its raw and true form so our clients can rely on accurate consumer data to drive their marketing decisions and strategies.

Experience Executing Surveys 🤓

Lastly, who better to execute an online survey than a market research company like Drive Research? Our team lives, breathes, and sleeps data.

With this type of experience, market research companies have an established and streamlined process for conducting ad concept surveys.

Contrary to popular belief, it is much more involved than writing survey questions and finding people to respond.

For instance, a qualified market research partner can easily determine what industry best practices will garner the greatest insights for your unique project needs and specifications.

Can your advertising or marketing consultant provide insight to...

- How many questions should you ask in my survey?

- Should you use a monadic or a sequential monadic survey design?

- How many advertising concepts should you test in the survey?

- Should you survey customers or non-customers?

- How many responses will you need for a low margin of error?

The answers to these questions will make or break an ad concept survey project.

It could mean the difference between collecting your goal of 1,000 responses which is representative of your market or only 50 responses with your friends and family members.

If your in-house marketing team or third-party marketing agency cannot answer these types of questions, we highly recommend you consider contacting a market research company instead.

In fact, Drive Research has already answered most of these questions in our market research blog.

💡 The Key Takeaway: Working with a third-party team for an ad concept testing project is essential for quality results. The feedback will not only be useful but it will be delivered to you objectively.

Recommended Reading: Benefits of Using a Third-Party Market Research Firm

How to Conduct Ad Concept Testing Surveys

How does an ad concept testing study work with a third party? Drive Research follows a systematic in-house approach our team has built for ad concept testing projects.

Our method uses a step-by-step and task-oriented approach to project management from kickoff through completion, guiding, and communicating with the client throughout.

While our market research company recommends outsourcing this project, this process can guide in-house marketing teams as well.

The process our market research firm follows for a concept testing survey includes the following stages.

Step 1: Design Your Advertisements 🎨

Hopefully, the design of your advertisements is based on research from the start.

This could be profiling specific buyers, understanding which channels to market on, or using the correct motivational language or buyer decision-making criteria.

Guessing on this? You shouldn't be. Qualitative research is a great route for discovery and exploratory research.

However, once you have your ads designed, you'll likely have several variations created. Perhaps an A/B or an A/B/C option.

Rather than basing the decision internally with your team or staff who have a horse in the race, think about using a third-party market research company to show the advertising options to real customers.

Step 2: Find the Right Market Research Partner 🔎

You will likely obtain several market research proposals from different firms. The bonus of market research is it can be done anywhere. Geography should not be a concern or a factor of choice.

For instance, our New York market research company works with brands in California, Florida, and England.

In a proposal, you will learn more about the firm's process, timeline, reporting options, and scope.

Before selecting your choice market research partner, understand that there are several things to consider aside from cost.

Here are the 4 greatest factors for choosing a market research vendor.

Step 3: Schedule a Kickoff Meeting 📅

Schedule a kickoff meeting with important stakeholders.

Take this time to discuss key objectives, project timeline, target audience, and expectations. Identifying your objectives and target audience is perhaps the most crucial aspect of a kickoff meeting.

These details will shape the market research tool and questions.

Additionally, after our advertising market research company meets with a client, we send a project workplan to assure both parties understand each step and the due date of the concept testing research.

Step 3: Decide Your Market Research Tool ⚒️

A market research tool is the type of methodology used to collect feedback. As with most projects, you have a few options here.

The 3 most common concept research tests are listed below.

Online surveys – This can be administered to customers or a targeted audience.

With this approach, you have the opportunity to show visuals of the ad or a video embedded in the survey to collect feedback.

Online ad concept testing surveys can test the likelihood to purchase, likes, and improvements for the ad.

Web surveys – This is administered to a random population of people that visit your website.

This is a great fit to test a landing page or intercept visitors on an e-commerce website if you want to test creative.

It allows you to ask questions to users in real time within the interface of the site structure you may be testing.

Focus groups – This can include customers or participants that match a targeted audience.

The third option is focus groups. This can be done in person or online.

As opposed to high-level measurements, focus groups are qualitative market research meant to explore deeper.

In this setting, you can show ads and creative to a group and ask questions to generate dialogue and feedback.

Here's a look at our focus group facility in Syracuse, NY. 👇👇

Each of these methodologies offers its unique pros and cons. For the purpose of this ultimate guide, Drive Research will utilize this section to focus on online surveys for ad concept testing.

- To learn more about web surveys, read: Website Surveys: How to Collect Feedback from Site Visitors

- To learn more about focus groups, read: The Ultimate Guide to Online Focus Groups

Step 4: Write and Program the Survey ✍️

Next, write your survey questions based on your objectives. There are two common survey designs for the purpose of ad concept testing.

This includes monadic testing and sequential monadic testing. We cover the advantages and disadvantages of these two formats later on in this ultimate guide.

To skip ahead, click Section 5 Monadic vs. Sequential Monadic Survey Design.

After our market research firm designs an ad concept testing survey in a word document, we send it for the client’s approval.

It is important both parties are satisfied with the questions being asked. Upon the client’s approval, Drive Research programs the online survey.

All of our online surveys are mobile-friendly and tested rigorously before launching.

Recommended Reading: 4 Common Issues When Launching an Online Survey (And How to Prevent Them)

Step 5: Launch the Survey 🚀

This is an exciting step in any market research study - but don’t jump the gun!

Before fully launching the survey to all respondents, only send the ad concept testing questionnaire to a small sample.

This verifies the survey is working as intended and respondents are comprehending questions as needed. More times than not, the soft-launch testing checks out.

Now it is time to fully launch the survey to a larger pool of respondents.

Lastly, our market research company recommends performing quality data checks as fieldwork continues. Do not leave this to the end.

There will likely be a few lackadaisical responses that should not be included in achieving your goal number of responses.

Step 6: Begin Analysis and Reporting 📈

Once your fieldwork is completed, the real fun begins. Another benefit of running advertising creative testing online is the results are typically available in real time.

Our market research company offers a passcode-protected link where clients can log in and view the data live.

This helps you make initial decisions on the data without having to wait for the topline or summary report. The client dashboard also offers cross-tabulations of charts and graphs.

Here is an example link to a live client dashboard.

In the analysis, you'll want to understand which of the ads (A, B, or C) was preferred and more importantly: "why"?

Reviewing the ad creative not only allows you to choose the ad that will perform the best but also tweak ads to make marginal improvements.

It's almost likely predicting the future a bit in helping you choose the best marketing path forward based on fact-based and evidence-based data.

If you decide to work with a third-party market research company, you will receive an in-depth report and analysis of the findings.

A good market research report for an ad concept survey will include the key findings, or main ideas, that were found in the feedback. But before we get into the findings, we’ll typically start the report off by detailing what the main project objectives were.

This step almost acts as a “reminder” of what the original project goals were.

A market research report can include components such as:

- Background and methodology. We'll typically start the report off by detailing what the main project objectives were.

- Snapshot of key findings and themes. A good market research report for an ad concept survey will include the key findings, or main ideas, that were found in the feedback.

- A breakdown of question-by-question results. To simplify things, there will be a key finding for each question in the survey. This question-by-question design makes the report easy to follow, so no insight will go unnoticed.

- Action-driven recommendations to apply the results in your advertising campaign. This data is all very important, but you’re probably thinking “what am I going to do with all of this information?” If you’re working with us, we’ll tell you what to do with the feedback.

- An infographic. Depending on the nature of your report, we’ll likely include at least one infographic, persona profile, and information about variable relationships.

- Next steps. Personalizing the data is also important, here. Understanding how the data relates back to your brand and your ad concept will give you the clearest vision possible.

💡 The Key Takeaway: The steps to launching a survey to test an ad concept are easily conducted when you know what to do (or are working with an outsourced team). Each step must be followed in order to gather proper data.

Recommended Reading: Breaking Down a Market Research Report Into 6 Pieces

Monadic vs. Sequential Monadic Survey Design

The choice between monadic and sequential monadic survey design can be a challenging one.

Each option has its own advantages and disadvantages. Let’s first start by discussing what the difference is between these two ad concept testing survey designs.

What is a Monadic Survey Design?

Let’s say you are conducting concept testing for three different advertisements:

- Concept A

- Concept B

- Concept C

You want to test these advertisements with 600 respondents. With monadic testing, respondents are broken down into different groups. Each group is assigned a different ad to provide feedback.

- 200 respondents provide their feedback on Concept A – never seeing Concept B or C

- 200 respondents provide their feedback on Concept B – never seeing Concept A or C

- 200 respondents provide their feedback on Concept C – never seeing Concept A or B

What is a Sequential Monadic Survey Design?

Keeping with the example above, let’s say you want to test three different advertisements (Ad A, Ad B, Ad, C) with 600 respondents.

In a sequential monadic survey testing, all 600 respondents would be shown all three advertisements and asked to provide their feedback for each.

The Advantages of a Monadic Survey Design

The main benefit of a monadic survey design is that respondents aren’t influenced by other ads.

Their full, undivided attention is on one ad. As a result, this removes any bias. For example, respondents won’t be distracted by liking the font from Ad A, but by the colors from Ad B.

Additionally, the survey is a lot shorter. Because you’re testing one ad at a time, a survey will take respondents 5 minutes.

Whereas, if respondents are testing three different concepts the survey can take 15 minutes to complete.

Our concept testing research company finds the shorter the survey, the higher the response rate. Shorter surveys can also lower the cost of market research.

The Advantages of a Sequential Monadic Survey Design

As a reminder, a sequential monadic survey design is when every respondent sees each ad concept that is being tested.

For this reason, the advantage of this approach is that brands have a larger sample size offering feedback for each advertisement.

The larger the sample size, the more accurate and reliable a market research study becomes.

Additionally, because each respondent sees each ad, an ad concept survey can include questions that compare and contrast each design.

For example, with a sequential monadic survey design market research companies can ask questions such as:

- Which advertisement did you like the least? Why?

- Which advertisement did you like the most? Why?

Our market research company recommends including no more than 3 advertising concepts in a sequential monadic survey design. Here’s why.

Which Survey Design is Better for Ad Concept Testing Surveys?

When presented with different survey designs, the next question our clients ask is - “What is better? Monadic or sequential monadic?

In all honesty, our market research team could be swayed either way. As we have noted, there really are advantages to using either approach.

With one exception.

Let’s say a brand has 20 different advertising concepts to test, with a goal of 2,000 survey responses.

Each advertising concept is accompanied by 5 questions. With 20 different concepts at 5 questions each, the brand would be creating a 100-question survey.

The likelihood of obtaining 2,000 responses on a 100-question, 60-minute survey would create all kinds of data quality issues.

In this scenario, it would make the most sense to create a monadic survey design.

Our market research firm would recommend splitting the 20 advertising concepts into individual surveys and collect 100 responses each.

This way, the brand is still achieving a representative subsample for each ad without overwhelming the respondent.

Think of it like this...

You sign up for a taste test with a restaurant to decide on their next burger. You are asked to taste 20 different burgers.

After tasting so many, they all start to blend together and you can’t differentiate why you liked one over the other.

Whereas, if you only tasted 3 burgers you can easily compare and contrast between the different flavors.

💡 The Key Takeaway: Monadic and sequential monadic surveys each carry their own set of advantages. Often, choosing one boils down to the amount and type of survey questions.

Ad Concept Testing Example Survey Questions

The questions included in an ad concept testing survey are heavily dependent on the brand’s objectives, target audience, and other varying factors.

However, this section will provide high-level ad concept testing example survey questions to give your team a better idea of what type of feedback can be collected.

- Which of the following [INSERT INDUSTRY] retailers are you aware of?

- Which of the following [INSERT INDUSTRY] retailers would you be willing to purchase from in the future?

- Review the images below for at least 10 seconds. Which of the images do you like the most?

- [Show image liked most] Please review the image below and share what you like about the image. Click on the image to provide feedback.

- Review the images below for at least 10 seconds. Which of the images do you like the least? Select one.

- [Show image liked least] Please review the image below and share what you don’t like about the image. Click on the image to provide feedback.

- Review the images below for 10 seconds and then hit, “Next”. Thinking about the images you just saw, which of the following offers do you recall? Select all that apply.

- After reviewing each of the offers below, what are the top 3 offers that are most enticing to you?

- After reviewing the images below, do you recall ever seeing ads like this for [INSERT BRAND]?

- After reviewing the image below, how likely are you to try services at [INSERT BRAND]?

Also, consider including demographic questions in your ad concept testing survey. This information can identify how different customer personas react to specific advertising messages.

For example, perhaps males are more likely to make a purchase after seeing Ad A, whereas females are more likely to make a purchase after seeing Ad B.

Example demographic survey questions for ad concept testing include:

- Which of the following best describes your age?

- Which of the following genders do you most identify with?

- Which of the following best describes your total annual household income?

- Which of the following ethnicities best describes you?

💡 The Key Takeaway: As in all surveys, ad concept questions are highly customizable to properly represent the brand.

Types of Ad Concept Survey Analysis

There are many directions to go when it comes to analysis for an ad concept survey. Some methods with high potential value include heat maps, TURF analysis, and text analytics.

Each of these analyses may help guide marketing decisions by validating messages, identifying underlying themes, and maximizing audience reach.

Below are overviews of each analysis outlining what they are, what benefits come with them, and what exactly they measure.

What are they?

In the context of market research, a heat map is a type of data visualization with varying shades of colors overlaying an image.

Warmer colors like yellow, orange, and red represent areas of the image with more frequent respondent selection.

In contrast, cooler colors like green, blue, and purple identify areas with less frequent respondent selection.

To obtain the data, researchers must ask respondents to review an image of interest and then select a point or points on the image according to the instructions.

Respondents are often directed to select areas that they like or dislike based on their own opinions.

See the heat map below which shows respondents' favorite Finger Lakes wineries to visit from our CNY Wine Survey.

What are the benefits?

Heat maps can be a valuable tool for testing advertising visuals. Let’s say there are a handful of social media ads your creative team has developed.

Using a heat map question for each in a survey, you can identify the most (or least) favorable aspects of each visual.

Many heat map questions even allow respondents to enter a comment to offer context for each point they select.

Learnings from the heat map results can help guide decisions like more prominently featuring an aspect of the image or removing another altogether.

Hot spots and comments on the heat map may also assist marketing teams in validating if the visuals convey the intended message.

What can it measure?

When including a heat map in your survey, there are many possibilities for metrics to measure. Standard metrics may be asking what respondents like or dislike within the tested visual.

Instructions can also be more specific, such as asking respondents to identify which part of the image best conveys the tested advertising message.

In any case, the heat map will then quantify how many respondents selected each area of the image.

The raw data is often less valuable, provided as coordinates that map a respondent’s selection on the visual.

What is it?

TURF analysis stands for Total Unduplicated Reach and Frequency. Generally speaking, TURF analysis is a statistical method used to achieve maximum reach with a fixed number of factors.

To correctly run this analysis, the survey must be designed with a multiple-response question in mind.

The analysis tests different combinations of factors in the multiple-response question to see which combinations include the highest number of unique respondents, or reach.

What are the benefits?

Running a TURF analysis can be very useful when you have a list of possible products or services but are limited to how many you can actually offer customers.

For example, let’s say you run an ice cream shop with 20 available flavors but only room for 5 kinds in your freezer.

A TURF analysis may reveal which 5 flavors reach the most potential customers. These may not be the top 5 flavors in overall popularity but combined they reach more unique customers than any other combination.

Another good application is to identify which combination of advertising keywords resonate with as many individuals in the target audience as possible.

In any case, you would follow the same process with a multiple-response question.

What can it measure?

As mentioned above, TURF analysis ultimately measures reach. Not to be confused with measuring overall preferences, TURF identifies the combinations of factors that get as close as possible to including 100% of respondents.

In this way, you may end up with less popular factors that reach a unique audience.

It is also important to note that there is no guarantee of compelling results with TURF analysis.

In some cases, the top overall factors and factors with the most reach will be one and the same. Output for TURF analysis will include each tested combination and the total corresponding reach.

What is it?

Open-ended responses in a survey can be overwhelming when you reach the reporting phase of a study.

There are numerous options for the analysis such as coding, listing cleaned responses, or running text analytics.

Text analytics is a newer approach that attempts to automate and quicken the analysis process.

It typically consists of inputting a list of open-ended responses from a survey into a program that uses artificial intelligence and natural language processing to draw insights from the data.

What are the benefits?

Text analytics can be incredibly valuable for how it streamlines the open-ended data analysis process.

The results often make quick work of discovering the overarching ideas within respondents’ text answers. The more responses vary, the more useful analytics will be.

If you are testing advertising stills or videos, text analytics can help identify what is driving a respondent’s interest, confusion, or discontent.

You may even be able to compare metrics from other parts of the survey with themes in the text analysis.

For example, you may want to see how willingness to buy your product varies based on how respondents answered the open-ended questions.

What can it measure?

After running text analytics, you can expect to see various outputs depending on the program you are using.

Themes within the data aim to quantify the open-ended responses by grouping responses around similar keywords or concepts.

The sentiment is another common metric with text analytics that measures the net positivity or negativity of individual responses.

This method uses universally assigned values to words in the English language to come up with an overall sentiment score.

Comparing sentiment scores across segments of respondents can help uncover insights.

Some text analytics programs also have the ability to run a deeper analysis of positive or negative attitudes such as love, fear, hate, desire, and skepticism sentiment.

💡 The Key Takeaway: Heat maps, TURF analysis, and text analysis are all ways market research companies can help analyze the findings of ad concept testing.

Recommended Reading: Using Sentiment Analysis in Surveys

How Long Does Ad Concept Testing Research Take?

The timeline for ad concept testing research is dependent on various reasons.

First and foremost, the methodology used to conduct the research will be the deciding factor for ad concept testing which takes days or weeks to complete.

1. Online Surveys 📱

Online survey feedback can be collected in as little as 24 to 48 hours. Our online survey company works as fast as our clients need us to.

Depending on how quickly the ad concept survey design is approved, the questionnaire can be in fieldwork within 24 hours.

Once the market research company understands more about your specific project, such as…

- How many questions would you like to ask?

- How many responses would you like to collect?

- Who is your target audience?

We can provide you with a more definitive timeline.

2. Website Surveys 🌐

Website surveys are conducted with users or browsers of your website. This includes both customs and those of the general public. Typically it is initiated at the time a user enters the site.

There are 3 options for conducting website surveys:

- Embedded Survey On-Site. The market research company will program an ad concept survey and send you an HTML code to embed on your website. This survey code can be embedded on any page of your site.

- Pop-up Survey In-Screen. A pop-up survey in a smaller window is shown on visitors’ screens. Respondents can complete the survey without ever leaving the website.

- Pop-up Survey Invitation. This is similar to the pop-up survey in-screen option however, respondents are invited to take the survey off-site.

The timeline of a website survey is less matter of fact.

Whereas our market research company can design and program the survey in as little as 24 hours, it is harder to gauge how quickly responses will come in.

For instance, websites with higher traffic will have an easier time achieving their goal number of responses in a week, whereas low-traffic websites might have to wait for 2 to 3 weeks for fieldwork to be completed.

3. Focus Groups 💬

Focus groups typically take about 5 weeks to complete. This ad concept research methodology takes longer than other approaches because there are more moving parts.

Brands interested in conducting focus groups must factor in time for qualitative recruitment, facility bookings, discussion guide creation, hiring a moderator, and more.

Drive Research can handle all of these logistics. With our onsite focus group facility in Syracuse, NY, and national qualitative recruitment services, we offer end-to-end project management for all qualitative market research needs.

There is also the option to conduct online focus groups. The timeline for remote focus groups can be cut in half compared to traditional, in-person group discussions.

Learn more about this approach in our Ultimate Guide to Online Focus Groups.

💡 The Key Takeaway: The length of time it takes for ad concept testing to be done hinges on the type of research used. For instance, a focus group project will take significantly longer than an online survey project.

The Cost of Ad Concept Testing Surveys

As we stated at the beginning of this ultimate guide, ad concept testing surveys are like taking a test drive before purchasing a car.

And just like when purchasing a car, there are varying prices for market research based on project objectives.

You wouldn’t walk into a car dealership and simply say, “What is the cost of a car?” without there being follow-up questions.

A car salesman would ask about your wants and needs such as the type of car, color, features, and so on. Based on your answers, the salesman will identify what car meets your criteria and give you a range of options for those expectations.

The same can be said when answering, “What is the cost of an ad concept testing survey?” It depends on several different factors - many of which our market research company discusses below.

Choice of Methodology 📱🖥️✉️

The choice of methodology will be the starting point for a market research proposal. A focus group often costs more than a phone survey. A phone survey often costs more than an online survey - and so on and so on.

Confide in your market research partner to determine what methodology is best for your objectives, target audience, and budget.

A trusted partner will not try to sell you on a methodology that is the most expensive but instead offer alternative approaches that meet your needs.

If you are looking for a more cost-effective approach to ad concept testing, online surveys will be the best methodology.

The Number of Survey Questions ❓❓

The more survey questions asked in an ad concept testing survey, the more money the project will cost.

It takes time for a market research team to write, program, and analyze each survey question - therefore project management costs rise when more questions are included.

The Goal Number of Responses 💯

Again, the more responses your brand would like to obtain, the higher a quote for ad concept testing will be.

The reason being it takes less time to find and report on 200 qualified respondents than it would for 2,000 respondents.

With that being said, the more responses collected, the higher quality of the data.

Our market research company does not recommend lowering your goal number of respondents to reduce the cost of market research.

There are likely other aspects of the study that can be refined to meet your budget.

Targeting Criteria 🎯

The targeting criteria of an ad concept testing survey reflect what type of respondent you would like to participate in the study. These are generally those that match your target audience or market.

For example, Drive Research conducted an ad concept testing survey for a beauty retailer.

The targeting criteria of the beauty market research included:

- U.S. consumers aged 18 to 60

- Female

- Primary or shared decision-maker for beauty

- Household income of $25,000 or more

- Interest in specific beauty products and services

- Purchased beauty products/services in the past 12 months

- Shopped for beauty/grooming products in the past 6 months

- Spend $8 or more in a typical month on beauty/grooming

- Aware of the beauty brand

- Willing to purchase from the beauty brand in the future

The more refined the targeting criteria, the higher the cost of market research.

It is easier to find respondents that are those of the general population than those who are Gen Z males, left-handed, and eat broccoli at least once a week.

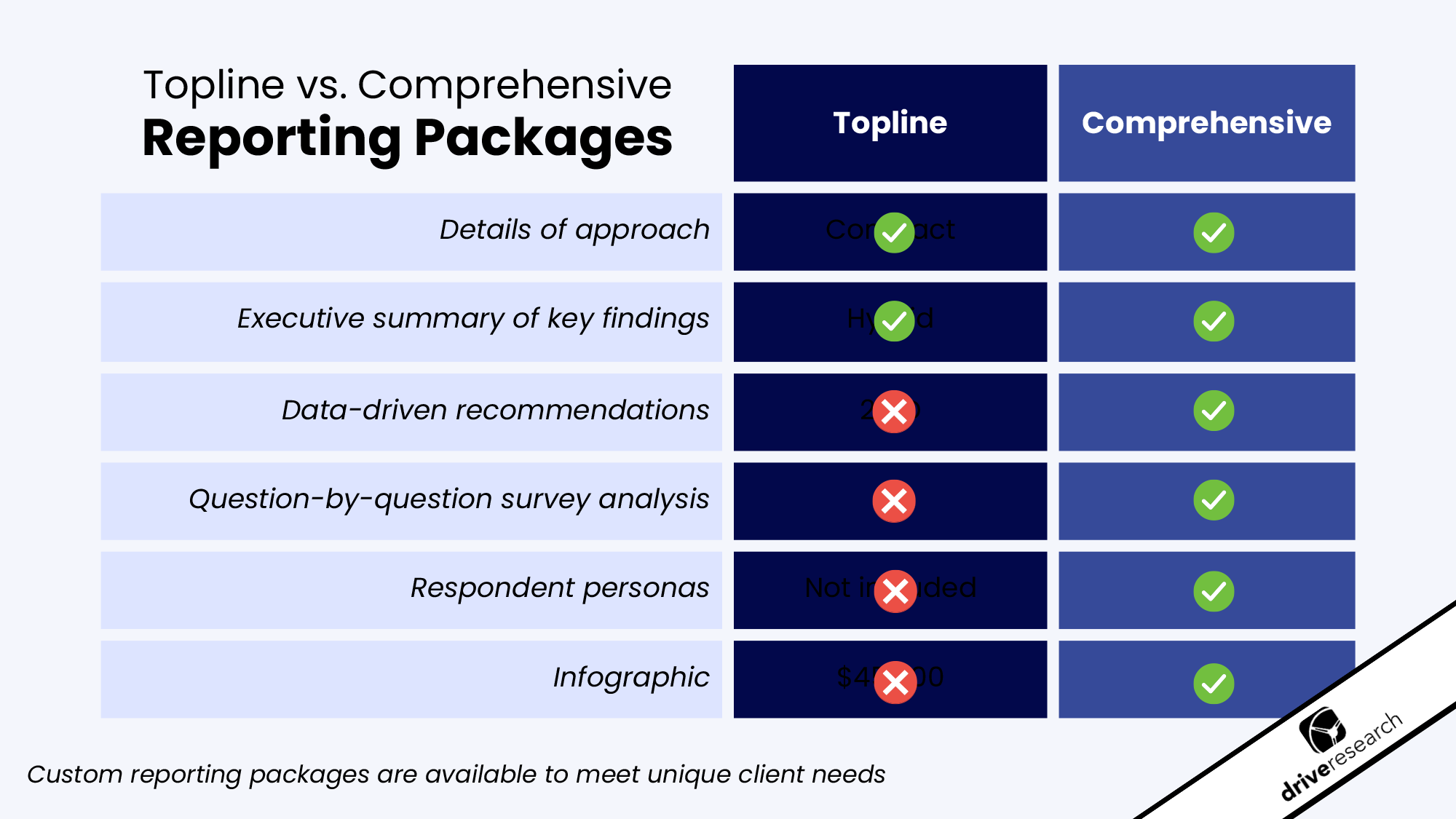

Reporting Package 🗂️

Lastly, the level of reporting needed for ad concept testing research will determine the project total.

While our market research company offers an al la carte approach to our reporting options, the two most common packages are a topline summary and a comprehensive report.

Topline Summary

A high-level Google document that reflects the objectives of the study, the approach or methodology leveraged, and key findings.

Comprehensive Report

A detailed PowerPoint including the study’s objectives, approach/methodology, infographic, a snapshot of results, key findings and expert recommendations, respondent personas, next steps for market research, survey analysis of each question, and copy of the survey document.

As you can tell by the difference in detail in each reporting package, a comprehensive market research report will be more expensive than a topline summary.

However, there are many more ways to repurpose the content of a comprehensive report that can increase the return on investment.

For example, a comprehensive market research report can be used to create lead-generating marketing messaging such as:

- Blog posts

- White papers

- Downloadable e-Books

- Webinars

- Website copy

- Social media posts

The opportunities are endless!

💡 The Key Takeaway: Like many aspects of market research, there’s no “right” answer for the cost of a project. However, the type of methodology chosen plays a significant role.

Ad Concept Testing Survey Case Study

Perhaps the best way to explain the process and benefits of ad concept testing is with a real-world client example from our market research company.

In this section, we share a case study of an ad concept testing survey Drive Research conducted on behalf of a life insurance company.

The Challenge ❌

Many people hate the concept of talking about or acknowledging their own mortality. Plus, there is little to no gratification that leads to making this type of investment.

As a result, selling and advertising life insurance is no easy feat. It requires unique advertising messaging that stands out and resonates with the target audience.

In this case, a life insurance company was interested in creating a marketing campaign with light-hearted and humorous undertones.

Because they were selling a sensitive topic, our client wanted to conduct ad concept testing to make sure they would not offend potential customers.

The Solution ✔️

Our New York market research company recommended using an online survey to collect feedback for the advertising concepts.

While there are a variety of methods one may choose for ad concept testing, online surveys are beneficial to those who are looking for quick, actionable, and inexpensive feedback.

The Approach 💡

To recruit respondents in the stated geographies, the concept testing survey was administered using a targeted email list to residents in defined geographies specified by the life insurance agency.

Survey targeting criteria

The targeting criteria for the ad concept testing survey included:

- Those aged 21 to 54

- All genders

- U.S. residents

- 80% parents and 20% no children

- Filtering out those who work in life insurance, advertising, and public relations

The number of survey responses

The life insurance company requested a sample size of 1,000, which offers a +/- 3% margin of error.

This means if the survey were conducted 100 times, 95 out of the 100 times results would yield within +3% or -3% of the stated totals.

The survey questions

The survey measured and explored emotions and attitudes around the advertising concepts. It included a mix of open-ended and closed-ended questions with visuals.

The concept survey also consisted of advertising videos from the client to gather the reactions of respondents.

The survey included questions such as:

- Overall did you think the campaign was funny, boring, offensive, relatable, opportunistic, unexpected, depressing, or light-hearted?

- Would you share this campaign with your friends?

- Does this campaign make you more like to consider [INSERT CLIENT NAME] for your life insurance needs?

- Do you have any other thoughts or feedback on the overall campaign?

The survey length

On average, the survey took no more than 7 to 10 minutes to complete and included up to 25 questions.

The Impact 💥

The results helped fuel the next steps in marketing and strategy for the life insurance company by offering facts and evidence from residents in the market area.

Based on respondent feedback the client was able to measure what percentage of their target demographic would resonate with the ad – or be offended.

While the actual results of the ad concept testing survey remain private with the life insurance agency, they were happy to have concrete evidence to guide their decision-making.

💡 The Key Takeaway: Online ad concept testing research not only gathers concrete data, but it also weighs the emotional impact an ad campaign can have on an audience.

FAQ About Ad Concept Testing

What is ad testing?

Ad testing is the market research process of vetting your ad concepts using a sample of your market/target audience. It establishes an ad's effectiveness before it launches based on consumer responses, analytics, feedback, and behavior.

What is the purpose of an ad test?

Ad testing is tracking and measuring different ads by using a participant sample. Typically the sample is taken from your target audience or market. Part of the project is asking for feedback and organizing it into useful data. It’s possible to run a project on a single ad or even specific aspects of it. The feedback is meant to show how successful the ad will likely be.

Does ad testing work?

It allows the campaigns to be more accurately measured before launching. It can also be used to improve the ad, stop the ad launch, or continue using the ad as planned. So yes, it does work since reliable and accurate data will tell you if the ad is going to be successful or not.

What are the objectives of ad testing?

Ad testing is used to find out how successful an ad can be and why. Ad tests can be done with various market research methods like surveys, A/B testing, focus groups, and more.

Conduct Ad Concept Testing Surveys with Drive Research

Drive Research is an ad concept testing market research company. Our team works with small and large organizations all across the United States and across the world. We can help you design, field, analyze, and report on an ad concept testing study for your company.

Contact Drive Research by filling out the form below or emailing [email protected].

Emily Rodgers

A SUNY Cortland graduate, Emily has taken her passion for social and content marketing to Drive Research as the Marketing Manager. She has earned certificates for both Google Analytics and Google AdWords.

Learn more about Emily, here.