In the intricate realm of banking in 2025, the significance of effective marketing strategies cannot be overstated.

As financial institutions grapple with dynamic market conditions, implementing different marketing approaches is imperative to not only stay competitive but also to foster customer engagement and loyalty.

To help, this blog post dives into several different bank marketing strategies to consider this year and their importance.

Plus, we’ll share real-world examples of financial institutions that ran successful marketing campaigns to further your inspiration.

What is Bank Marketing?

Bank marketing refers to the strategies and tactics financial institutions use to attract, engage, and retain customers. It involves a series of different tactics all with the goal of promoting banking products and services—such as loans, credit cards, and savings accounts. Common marketing strategies for banks include digital advertising, content marketing, personalized outreach, and community engagement.

But, effective bank marketing isn’t just about promoting products—it’s about helping people feel confident and secure in their financial decisions. People are naturally protective of their finances, which makes trust a key factor when choosing a FI.

As expectations evolve, banks must take a customer-first approach, using data-driven insights and innovative strategies to meet people where they are and earn their trust.

Why Marketing for Banks is Important

Marketing for banks is crucial to navigating dynamic market conditions, fostering customer engagement, and sustaining competitiveness in an ever-evolving financial landscape.

Here are common reasons banks and credit unions implement marketing strategies.

Brand Awareness and Visibility

A solid marketing campaign will help banks boost their visibility, naturally resulting in increased brand awareness.

Common ways for banks to build awareness is through channels like…

- Television

- Social media posts

- Online advertising

- Print media

- Community outreach

Continuously tracking brand awareness is important for long-term success. This form of research will reveal details like perception, usage rates, and net promoter score.

This data will help marketing and related teams understand how their outreach strategy ranks.

Customer Acquisition and Retention

As we mentioned, customer relationships with marketing financial institutions are strengthened by implementing brand awareness strategies.

This is a crucial part of a bank’s marketing strategy.

Not only will this help with customer retention, but a good marketing strategy also attracts new people to a bank.

This is because by highlighting key features like unique services, products, and features, banks can set themselves apart from their competitors.

While this varies depending on the bank, common marketing materials that can help strengthen customer relationships include loyalty programs, financial wellness materials, and similar offerings.

Customers appreciate when banks go the extra mile in providing sources like this, as it adds to the experience.

Recommended Reading: Strategies to Grow Customers at a Bank or Credit Union

Promotion of Products and Services

Since banks offer so many services (savings accounts, loans, credit cards, investment options, digital banking solutions, etc.), it’s key that each of them is promoted correctly.

Customers must be able to differentiate between each of a bank’s services.

This can be accomplished through a well-rounded marketing strategy.

By offering content around each of their services, banks can be sure customers understand the full scope of available services.

Ultimately, this also increases the likelihood of a customer having a positive experience when utilizing these services. If each service is well-documented, then they know for sure which one they should be choosing based on their unique needs.

Best Marketing Strategies for Banks in 2025

Choosing the best marketing strategy for your bank depends on several different factors. Whether it be aligning with budget constraints or finding the best source to reach your target audience – every financial institution will have a different approach.

Luckily, there are plenty of different marketing tactics to choose from.

Top banking marketing strategies in 2025 include:

- Optimizing local marketing efforts

- Delivering valuable content

- Segmenting customers based on unique needs

- Publishing targeted Google Ads

- Focusing on customer retention

- Investing in CRM systems

- Conducting customer surveys

- Forging partnerships with local businesses

Let’s dive into each of these a bit further.

Optimize Local Marketing Efforts

Almost all customers check online reviews before visiting a business. This is why it’s important banking platforms use local SEO and Google My Business profiles.

Updating local directories on a regular basis ensures the information stays fresh and can also help with online visibility.

Adding onto this, continue to use local keywords to boost your reach. Creating unique landing pages for each branch is also important, as this can help with targeted messaging and user experience.

Deliver Valuable Content

Another huge aspect of bank marketing strategies is the content they put out.

This is not to be looked over for banks, as customers will pick up on if they offer poor or quality content.

In fact, up to 63% of marketers believe that effective content nurtures customer leads.

And since banks offer so many services, a good content marketing strategy is especially important. But what kind of content can banks use effectively?

A few bank content marketing ideas include:

- Comprehensive guides

- Blog posts (tips, advice, etc.)

- Infographics

- Info on products/services

- Customer spotlights/testimonials

These suggestions are purposely broad bank marketing strategies as every institution is different and services a wide audience.

That said, each of the options listed above are different ways an effective content marketing strategy can service customers.

Segment Marketing by Customer Persona

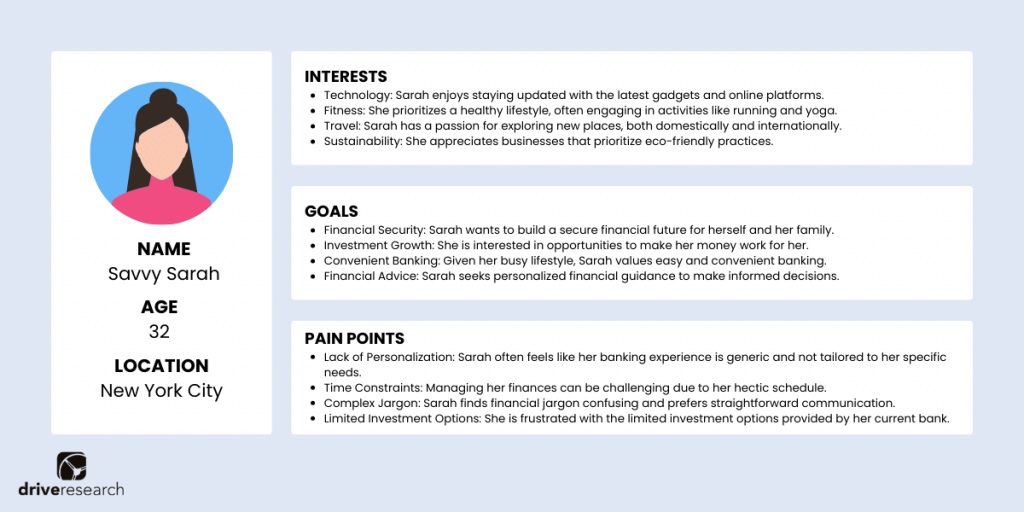

At this point, we can gather that marketing for financial institutions involves a clear knowledge of who their customers are.

After all, how can a bank (or any business) market their offerings if they don’t understand their audience? They can’t!

This is why developing customer personas is crucial in 2025.

Customer personas are not a “real” customer.

Rather, based on accurate data, they represent the ideal version of a business’ customer. In this case, a bank’s customer persona would represent a single figure out of its target audience.

Personas will allow marketing teams to better target their efforts, saving them both time and money – plus ideas for how to bring in new customers.

Common ways personas can be worked into marketing for banks include:

- Content marketing strategies

- Customer retention efforts

- Improving customer experience outreach

These personas are essential because they help customize a bank’s marketing strategies to align with real consumers. As a result, they can be sure content and additional marketing materials are having the desired effect.

Deploy Targeted Google Ads

When marketing for banks, creating localized Google Ads campaigns and ensuring they remain active is also key.

Doing this will expand the reach and likely end up attracting more customers who are searching for specific offerings and bank provides.

Additionally, bidding on keywords specific to branch locations such as, ‘Banks Near Me’ or ‘Banks in New York City’ can help attract local customers.

This move is helpful in expanding the local awareness of a bank and catching the eye of potential customers.

Focus on Customer Retention

When marketing for banks, remember to not forget your current customers.

Sometimes, businesses may put too much emphasis on attracting new customers. This can leave current customers in the dust, harming retention rates.

Instead, banks should spend an equal amount of time nurturing current customer relationships while still working to attract new ones.

A few good ways to maintain this relationship include:

- Offering diversified services

- Personalized assistance

- Upsell or cross-sell services based on customer needs

Continuing to cater to current customers will increase loyalty rates. What’s more, over time, this will brand a bank as truly caring for its customers.

Invest in CRM Systems

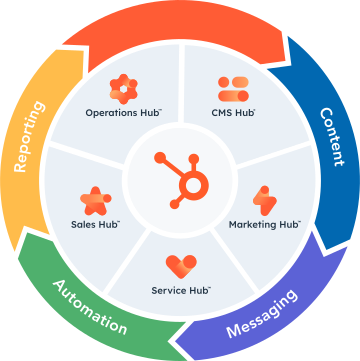

CRM (customer relationship management) systems are a key investment in a bank’s marketing strategy.

These systems help streamline marketing and sales outreach, helping banks track their customer interactions with ease. And with institutions as busy as banks, this is especially needed to understand customer insights.

Furthermore, CRM systems such as HubSpot typically integrate well with similar platforms like social media and email campaigns.

This is advantageous for banks, as they can get a well-rounded view of customer data.

Using this feedback, banks can effectively move with customer trends over time using data-driven insights.

This not only improves marketing strategies and customer engagement but also allows banks to have confidence in moving forward with these strategies.

Conduct Customer Surveys

So far, we’ve touched on many marketing strategies that revolve around customer data.

The best way to gather this data is through bank customer surveys.

Gathering customer feedback, done most commonly via online surveys, provides accurate data that can assist in implementing all of the strategies we’ve already covered.

With customer surveys, banks can expect to learn information about:

- Common pain points

- Current customer trends

- Banking preferences

- Areas of improvement

- Current systems that are working well

With all this data, the options for a bank’s marketing strategies are endless. Instead of going in with no solid ideas on how to improve their experience, bank marketing teams can base their outreach strategies on survey findings.

Our financial services market research company recommends incentivizing these surveys to encourage response rates, with actions like giveaways or rewards.

Forge Partnerships with Local Businesses

Last but not least, banks need to explore partnership opportunities with other businesses.

Customers appreciate brands that make an effort to get involved in the community, as it shows they care about making a local impact.

Not only is this helpful in customer relations, but working with local businesses also allows banks to target clientele.

For starters, banks can begin to target community leaders and businesses that align with their mission. These partnerships aren’t designed to be short-term, think of it as a long-term strategic investment.

A few ways to develop partnerships with businesses in your area are…

- Supporting local entrepreneurship centers

- Getting involved with local volunteer organizations

- Corporate giving programs

Again, not only are these bank partnerships good for business, but they show customers that they care about the well-being of their community.

Examples of Successful Banking Marketing

Multiple banks have used marketing campaigns that took off with their target audience. From catchy slogans to using A-list celebrities, the examples below showcase how effective a bank’s marketing strategy can be.

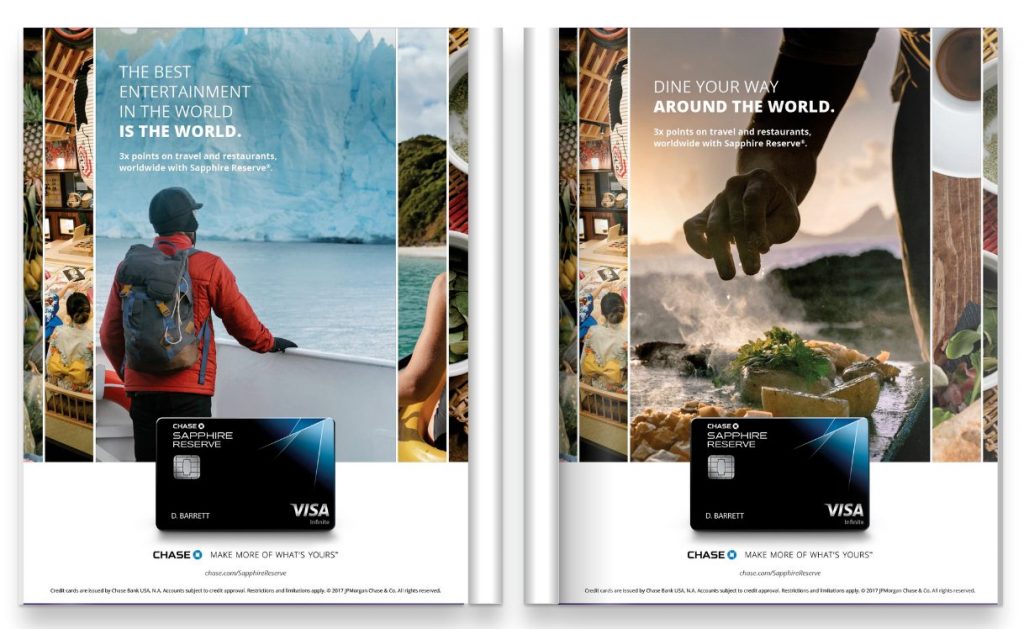

Chase Bank’s “Chase Sapphire Reserve” Campaign

To pair with the launch of their Chase Sapphire Reserve credit card, the bank crafted a successful marketing campaign to cater to affluent travelers.

Boasting premium travel benefits like airport lounge access and extensive reward points for travel expenses, the campaign brought in a large number of high-value customers and became recognized throughout the travel community.

Wells Fargo’s “Building Better Every Day” Campaign

Wells Fargo’s “Building Better Every Day” was centered around rebuilding trust amongst consumers.

Designed to combat a series of recent scandals, the bank’s campaign focused on its commitment to customer services, its community involvement efforts, and ethical business practices.

Designing an approach from all angles, the bank used television commercials, digital advertising, and community outreach initiatives to rebuild its image.

Bank of America’s “Life’s Better When We’re Connected” Campaign

The “Life’s Better When We’re Connected” campaign, designed by Bank of America, focused on the human aspect of banking.

Centering around connectivity with customers, this bank’s marketing strategy covered points like its digital capabilities, personalized banking solutions, and commitment to creating long-lasting customer relationships.

This bank strategically used various channels like television, social media, and other digital platforms to earn customers’ trust as a dedicated financial partner.

Ally Bank’s “Do It Right” Campaign

Ally Bank’s “Do It Right” campaign centered around three main topics: transparency, simplicity, and customer-centricity in the banking space.

“Do It Right” emphasized Ally Bank’s dedication to trustworthy banking practices (no hidden fees, competitive interest rates, 24/7 customer support).

By using clever ads, quality social media content, and educational initiatives, this bank aimed to stand out from traditional banks and gain the interest of tech-savvy customers.

Capital One’s “What’s in Your Wallet?” Campaign

Enlisting the help of celebs like Jennifer Garner and Samuel L. Jackson, Capital One’s “What’s in Your Wallet?” campaign has built immense brand recognition and successfully engaged customers.

Embracing humor, the campaign uses memorable slogans to showcase the many benefits of Capital One’s credit cards and financial products.

Combining unique marketing strategies and celebrity appearances, Capital One’s campaign has effectively captured consumers with its value proposition.

Contact Our Banking Market Research Company

A bank’s marketing strategy is everything when it comes to developing and maintaining consumer relationships.

Drive Research specializes in both marketing and market research for banks and credit unions.

Our team is skilled in working with banks and financial institutions to deliver timely, actionable data to create successful marketing campaigns based on data.