The love for coffee is deeply ingrained in many cultures around the world. It is not only a morning ritual or a pick-me-up during the Indulging in fast food has become a cornerstone of modern dietary habits, shaping the way many of us approach mealtime.

Knowing that we surveyed over 950 consumers to collect the latest and most essential fast food consumption statistics such as:

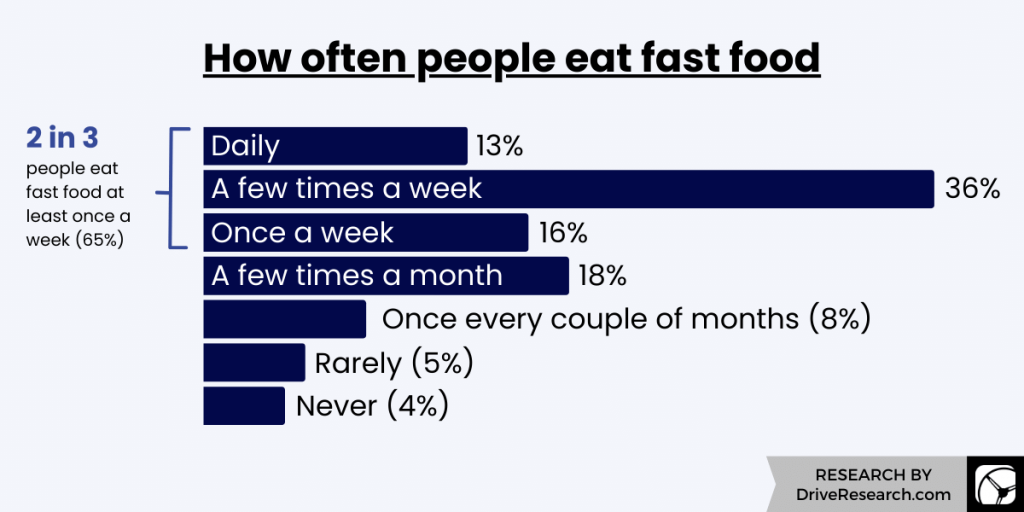

- 2 in 3 people consume fast food at least once a week (65%)

- Males are nearly three times more likely to eat fast food daily than females

- On average, people spend $148 on fast food each month

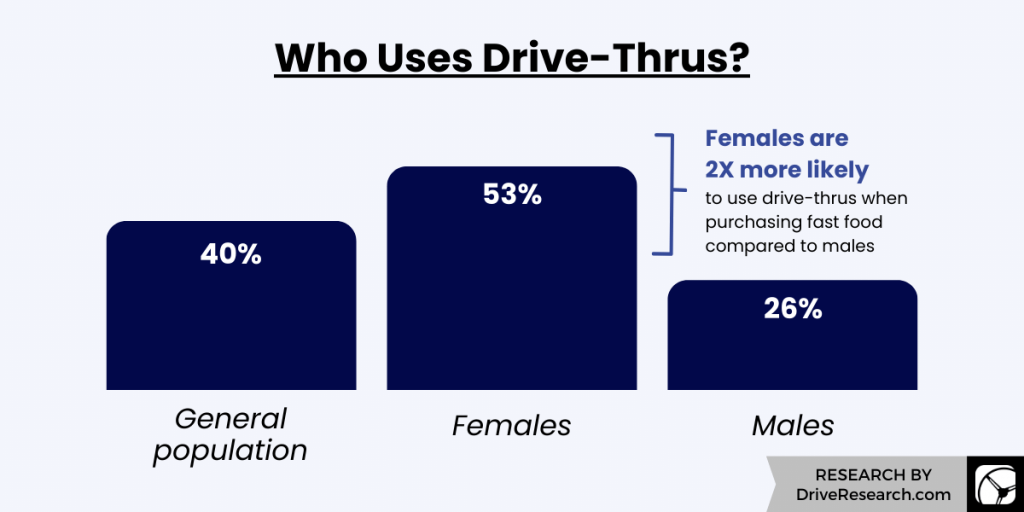

- 40% of American consumers use drive-thrus to purchase fast food

- Millennials report online food delivery as their top preference for purchasing fast food

From the frequency of visits to favorite fast food french fries, spending habits, and even the differences among demographics, below we dissect the trends that define America’s relationship with fast food.

Fast Food Consumption Report

"*" indicates required fields

How many people eat fast food?

95% of people have eaten fast food in the past twelve months

Fast food chains are prevalent in most urban and suburban areas. They offer quick, convenient, and often inexpensive meals, making them a popular choice for people with busy lifestyles or limited time for meal preparation.

2 in 3 people consume fast food at least once a week (65%)

This statistic sheds light on the prevalent role of fast food in modern diets. It indicates that a significant majority of individuals incorporate fast food into their weekly routine, showcasing its widespread popularity and accessibility.

13% of people consume fast food every day

This figure emphasizes the high frequency at which a notable portion of the population turns to fast food for their meals. It prompts reflection on the societal factors that contribute to such regular consumption patterns.

Only 4% of people reported never eating fast food in the past year

This statistic demonstrates the rarity of individuals who entirely abstain from fast food over an extended period. It reflects the pervasive influence of fast food on modern dietary habits, potentially indicating challenges in maintaining healthier eating patterns for a significant portion of the population.

Millennials eat fast food more frequently

Our survey highlighted some generational differences as well. Millennials were the generation to most commonly report eating fast food more often. More specifically, 54% of millennials report eating fast food a few times a week, with 23% consuming it daily.

Males are nearly three times more likely to eat fast food daily than females

20% of males report eating fast food every day, while only 7% of females report eating fast food daily. Moreover, nearly half of all males surveyed reported eating fast food a few times a week in the past year (45%). While females most commonly ate fast food a few times a month (23%).

People with higher incomes consume fast food more frequently

Of those surveyed, people with household incomes (HHIs) of $100K or higher were more likely to consume fast food weekly. More specifically, those with a HHI of $100K to $149,999 reported eating fast food daily (22%), a few times a week (50%), and once a week (13%). Additionally, those with a HHI of $150,000 or more eat fast food daily (25%), a few times a week (52%), and once a week (7%).

How much money do people spend on fast food?

On average, people spend $148 on fast food each month

Fast food establishments are known for their convenience and accessibility, making them an attractive option for individuals with busy lifestyles or those seeking a quick meal solution. The relative affordability of many fast food items, when compared to dining at sit-down restaurants, may also contribute to this monthly spending average.

Each month, males spend nearly $100 more on fast food than females

According to our research, males spend an average of $196.10 on fast food each month, while females spend an average of $99.30. This discrepancy could be attributed to a variety of factors.

One potential explanation is differences in dietary preferences and consumption habits between genders. It’s possible that males, on average, tend to gravitate towards fast food options more frequently or in larger quantities than females. This could be influenced by factors such as taste preferences, nutritional needs, or even cultural and societal norms.

Millennials spend over $214 every month on fast food – over 3X more than Baby Boomers

On average, millennials report spending $213.87 each month on fast food while baby boomers report an average of $59.43 each month. Other generations such as Gen X report spending an average of $163.68 each month on fast food and Gen Z report spending an average of $119.68.

84% of people believe that fast food is more expensive today than it was five years ago

What’s more is that nearly half of those surveyed, 45% of consumers believe that fast food is significantly more expensive than it was five years ago. This shift in perception may be attributed to various factors, such as changes in production costs, inflation, and shifts in consumer preferences.

How many people use drive-thrus?

40% of American consumers use drive-thrus to purchase fast food

40% of American consumers utilize drive-thrus to purchase fast food is indicative of the widespread reliance on this quick and accessible method of obtaining meals. This figure showcases the enduring appeal of drive-thrus as a preferred mode of service for a significant portion of the population.

Females are 2X more likely to use a drive-thru than males

Our fast food consumption survey found that 53% of females prefer to go through the drive-thru when purchasing fast food, while only 26% of males use the drive-thru.

One possible explanation for this difference could be related to convenience and time management. Females may, on average, have busier schedules due to a variety of responsibilities, such as work, household chores, childcare, or other commitments.

As a result, they may be more inclined to opt for the convenience of a drive-thru, which offers a quicker and more efficient way to obtain meals.

Additionally, safety considerations might play a role. In certain contexts, individuals, particularly females, may feel more secure remaining in the safety of their vehicles while obtaining their food, especially during nighttime hours or in unfamiliar areas.

Baby Boomers (55%) and Gen Z (48%) are most likely to use drive-thrus

For the Silent Generation, this high usage of drive-thrus may be influenced by factors such as convenience and comfort.

On the other hand, for Gen Z, the high utilization of drive-thrus may be linked to a range of factors. This generation has grown up with technology and is often accustomed to instant gratification and seamless experiences. Drive-thrus, with their quick and efficient service, aligns well with the preferences of a digitally savvy demographic.

For further context, our research found that 43% of Gen X uses the drive-thru while only 21% of millennials utilize the drive-thru when purchasing fast food.

Convenience (62%) and faster service (47%) are the biggest reasons people prefer drive-thrus

Several factors contribute to the popularity of drive-thrus. Firstly, they offer unparalleled convenience, allowing individuals to order and receive their food without leaving the comfort of their vehicles.

Secondly, with people often pressed for time, this mode of service allows for a streamlined and time-effective dining experience. This convenience is especially valued by individuals who may be commuting, in a rush between activities, or seeking a quick meal solution.

Other reasons people prefer drive-thrus for purchasing fast food include:

- The privacy of eating in their car (41%)

- It’s cheaper than food delivery (28%)

- The food is fresher (16%)

- The extended operating hours (12%)

- The inside of fast food establishments are not clean (8%) and have limited seating (7%)

Enjoying dining in the restaurant (44%) and more time to explore the menu (40%) are the biggest reasons people prefer purchasing fast food inside the restaurant

According to our survey, other reasons people prefer purchasing fast food inside the restaurant include:

- Easy access to free refills, condiments, extra napkins, etc. (39%)

- It’s cheaper than food delivery (33%)

- Faster service (32%)

- More convenient (32%)

- Liking the personal interaction (32%)

- The food is fresher (28%)

- Being with someone who prefers going inside (21%)

- Not comfortable with ordering online (18%)

What percentage of people order food delivery?

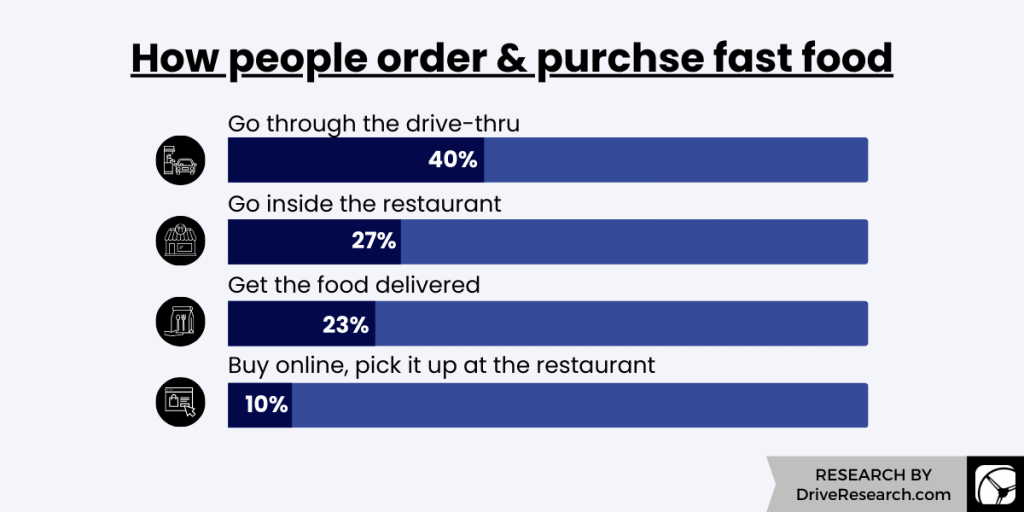

23% of American consumers prefer getting fast food delivered, while 10% prefer to buy food online and pick it up at a restaurant

The fact that nearly a quarter of American consumers (23%) prefer having fast food delivered indicates a significant shift in consumer behavior towards convenience and on-demand services. This preference is likely influenced by several factors as we’ll discuss below.

Males are nearly 2X more likely to get fast food delivered than females

This preference may be influenced by various factors, including lifestyle, convenience, and perhaps differing attitudes toward food delivery. Another factor to consider is the perception of food delivery. Males may view it as a hassle-free way to access their favorite fast food items, while females may have different preferences when it comes to meal preparation or dining out.

Millennials report online food delivery as their top preference for purchasing fast food

According to our fast food consumption survey, millennials stand out as the demographic group most inclined towards online food delivery as their preferred method of obtaining fast food (39%). This preference aligns with the tech-savvy nature of this generation, which has grown up in an era of digital convenience and accessibility.

While not their top choice, 21% of Gen Z, 19% of Gen X, and 8% of Baby Boomers prefer online food delivery for further context.

Convenience (58%) and privacy (50%) are the biggest reasons people get fast food delivered

The rise of food delivery platforms and apps has made it incredibly convenient for individuals to order their favorite fast food items from the comfort of their homes or workplaces.

According to our survey, other reasons people prefer online fast food delivery include:

- Being able to continue with other activities without interruption (42%)

- Avoiding crowds and long lines (39%)

- Using exclusive deals and menu items when ordering online (34%)

- Preferring the contactless experience (30%)

- Inside fast-food restaurants have limited seating (20%) and are unclean (18%)

- Not having access to a car or other forms of transportation (16%)

Convenience (52%), faster service (49%), and avoiding lines are the biggest reasons people buy fast food online and pick it up at the restaurant

These three key factors highlight the shifting consumer preferences towards more convenient and time-effective dining experiences. It’s clear that technology-driven solutions, such as online ordering platforms, have revolutionized the way individuals interact with fast food establishments.

According to our survey, other reasons people prefer BOPOS include:

- Having more time to explore the menu (45%)

- There are exclusive deals and menu items when ordering online (42%)

- Scheduling their pick-up time (39%)

- It’s cheaper than getting the food delivered (36%)

- Preferring the contactless experience (28%)

- Not trusting/having bad past experiences with delivery (15%)

How do customers choose a fast food restaurant?

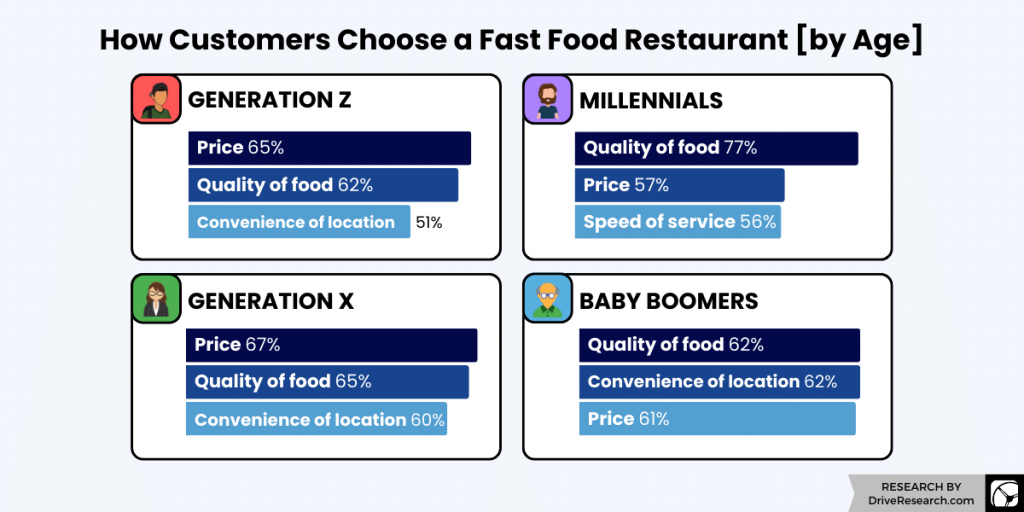

Quality of food (68%) and price (62%) are the biggest influential factors for what fast food restaurants people purchase from

These two influential factors highlight the dual importance of balancing quality with affordability in the fast food industry. Consumers are seeking a balance between enjoying a flavorful and satisfying meal while also getting good value for their money.

Other factors of fast food restaurant choice include convenience of location (57%), menu variety (51%), speed of service (42%), healthy options (34%), and brand reputation (33%).

Males most value the quality of food (73%) while females equally value price (63%) and quality (63%) when it comes to choosing a fast food restaurant

Additionally, males more commonly reported speed of service (50%) as a top factor when choosing a fast-food restaurant but it was only important for one-third of females (35%). On the other hand, females appreciate menu variety (53%) more than males (49%).

Gen Z and Gen X were more likely to value price over the quality of food when choosing a fast food restaurant

Gen Z’s familiarity and comfort with technology may lead them to seek out deals, promotions, and value-oriented options when making dining choices. Online platforms and apps that offer discounts and special offers might have a significant influence on their decision-making process.

Gen X, on the other hand, is a generation that has experienced economic shifts and transformations. They might place a higher emphasis on price due to a range of factors, such as family responsibilities, mortgage payments, or saving for retirement.

What fast food restaurant has the best fries according to customers?

McDonald’s has the best fast food french fries according to nearly 1 in 4 Americans (24%)

According to our survey, McDonald’s was rated the best fast food restaurant for french fries by nearly a quarter of all respondents. Other top answers included Burger King (12%), Chick-fil-A (9%), Wendy’s (7%), and Arby’s (6%).

Millennials are more likely to prefer Burger King fries over McDonald’s

Millennials were the only generation to rate Burger King fries (16%) better than McDonald’s (13%). Burger King’s fries are known for their thicker cut and slightly different seasoning compared to McDonald’s. Millennials may have a preference for the taste and texture of Burger King’s fries.

Gen Z enjoys Chick-fil-A fries more than any other generation

While Gen Z respondents most preferred McDonald’s french fries (22%), Chick-fil-A was a close second (18%). Gen Z was the only generation that rated Chick-fil-A fries as their second favorite of all fast food establishments.

Has the quality of fast food gotten better?

Nearly 1 in 2 Americans agree the quality of fast food has improved in the past five years (48%)

This is a promising indication of positive shifts within the fast food industry. It suggests that investments in menu innovation, ingredient sourcing, and cooking techniques are resonating with consumers. Therefore, fast food chains should emphasize and sustain these improvements to help build trust and loyalty among customers.

Males are more likely to report the quality of fast food has improved (63%) in the past five years over females (34%)

The fact that a significant majority of males perceive an improvement in the quality of fast food suggests that they have observed positive changes in various aspects of the fast food experience. This may include factors such as taste, freshness, ingredient quality, and overall dining experience.

While females don’t share the same sentiment. They were more likely to report the quality of fast food to be the same as it was five years ago (43%).

Millennials are more likely to report the quality of fast food has significantly improved in the past five years (47%)

Overall, 77% of millennials reported that the quality of fast food was better than it was five years ago, with 47% going as far as to report it being significantly better. Conversely, many Baby Boomers (55%) and Gen Z reported the quality being the same (46%).

53% of customers agree that fast food restaurants offer enough healthy options

The fact that over half of customers (53%) agree that fast food restaurants offer enough healthy options is an encouraging sign. This suggests that a substantial portion of consumers believe that the industry has made strides in providing healthier alternatives alongside traditional fast food fare.

Survey Background and Methodology

Figures in this fast food market research report are drawn from an online survey conducted by Drive Research to better understand fast food customers Drive Research is a national market research company based in Syracuse, NY.

The survey took up to 10 minutes to complete and included 36 questions. The survey received 955 responses from those who have consumed fast food in the past twelve (12) months. Fieldwork for the survey ended in July 2023.

Download the Fast Food Consumer Report

Dozens of new statistics and insights to help fast food restaurants, online food delivery sites, and marketing agencies learn practical and relevant information to improve decision-making. Plus, the full report breaks down survey results by various demographics such as age, gender, income, and region.

"*" indicates required fields